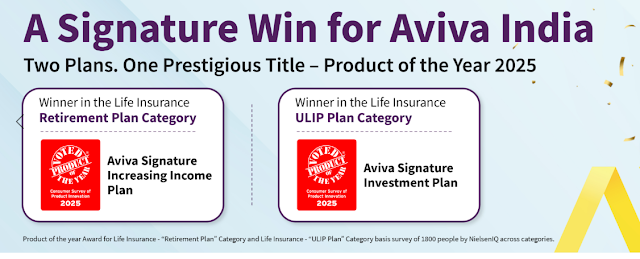

Aviva Life Insurance Wins Product of the Year 2025: In a landmark achievement, Aviva Life Insurance has secured the prestigious Product of the Year 2025 title in two pivotal categories — Retirement Income and ULIP (Unit Linked Insurance Plan). This accolade is not merely an industry recognition but a consumer-driven validation, determined through a nationwide survey conducted by NielsenIQ under the 17th edition of Product of the Year in India. The consumer vote reflects the company’s unwavering commitment to innovative, need-based solutions tailored to the evolving financial landscape of Indian households.

The award-winning products — the Aviva Signature Increasing Income Plan and the Aviva Signature Investment Plan — exemplify the company’s forward-thinking approach. These offerings are crafted with a keen eye on simplicity, flexibility, and customer empowerment. As the financial climate becomes more complex, these products help customers build stable retirement income streams and engage in goal-oriented wealth creation, all while staying protected with life insurance coverage. With this recognition, Aviva India further solidifies its position as a trusted brand delivering future-ready financial solutions.

Commenting on this milestone, Asit Rath, CEO & MD of Aviva India, stated, “We are truly honoured to be recognised as Product of the Year 2025 in two key life insurance categories: Retirement Income and ULIP. These products were thoughtfully designed to address our customers’ real-life needs, whether it’s creating a reliable stream of income post-retirement or building a disciplined investment habit for the future.” This customer-first approach is echoed across Aviva’s corporate philosophy and is a major reason behind its popularity among Indian families.

Who Can Apply for Aviva Signature Plans?

Both Aviva Signature Increasing Income Plan and Aviva Signature Investment Plan are open to Indian residents, typically between the ages of:

- 18 to 65 years for the Aviva Signature Investment Plan (depending on the policy term selected)

- 30 to 60 years for the Aviva Signature Increasing Income Plan

These plans are ideal for:

- Salaried employees planning for retirement

- Entrepreneurs seeking long-term savings

- Young investors looking for ULIP benefits

- Families seeking financial protection with returns

Insurance Fees & Charges

Aviva Signature Increasing Income Plan

- Premium: Starts from ₹50,000 annually (varies based on age and chosen income term)

- No hidden charges

- Optional riders like Accidental Death Benefit at nominal rates

Aviva Signature Investment Plan

- Zero premium allocation charges

- Fund Management Charges: ~1.35% annually

- Mortality Charges: Refunded on maturity

- Policy Administration Fees: Nominal monthly charge

These plans offer value-for-money through transparent fee structures, low charges, and high returns potential.

How to Use the Aviva Signature Plans

For Retirement Income:

- Choose the payout period (up to 40 years)

- Receive guaranteed increasing income

- Customize the plan with optional riders

- Ideal for creating a steady post-retirement financial flow

For ULIP Investment:

- Pick from 8 diversified funds

- Use unlimited free switches to manage investments

- Leverage zero premium allocation and loyalty additions

- Perfect for wealth building and goal-based savings

Benefits of Aviva Signature Plans

Guaranteed Income with built-in increases (for the income plan)

Zero Premium Allocation Charges (for the investment plan)

Comprehensive Life Cover across both offerings

Customizable Options with flexible policy terms

Accidental Death Benefit Rider for added safety

Unlimited Fund Switching for smart investment management

Loyalty Additions at maturity to boost fund value

How to Apply for Aviva Signature Plans

You can easily apply through the following channels:

Online Application:

- Visit the official site: www.avivaindia.com

- Select your desired plan

- Enter personal details and calculate premium

- Upload KYC documents and make payment

- Policy issued digitally

Offline Application:

- Visit an Aviva branch

- Contact a registered insurance advisor

- Submit required forms and documents

- Complete the medical and verification process

Important Dates

- Award Announcement Date: July 4, 2025

- Plans Currently Open for Purchase: Yes

- Availability: Pan India (Online + Offline channels)

- Customer Support: 1800-103-7766

Disclaimer

This article is for informational and educational purposes only. It is not intended as financial advice. Please read the full policy brochure and consult with a certified financial advisor or insurance agent before purchasing any insurance product. Aviva Life Insurance and its products are regulated by IRDAI. The awards and recognitions mentioned are based on consumer surveys and external third-party audits. Terms and conditions apply.

Aviva Life Insurance Wins Product of the Year 2025 Conclusion

Aviva Life Insurance has showcased its industry leadership once again with the Product of the Year 2025 recognition. Winning in both the Retirement Income and ULIP categories shows the strength and versatility of its insurance offerings. With products like the Aviva Signature Increasing Income Plan and the Aviva Signature Investment Plan, the company reinforces its vision of financial inclusion and innovation for every Indian household.

What truly sets Aviva apart is its customer-first design philosophy. Every feature – from increasing income and rider benefits to zero allocation charges – is built with clarity and purpose. It speaks directly to the real needs of today’s policyholders, who seek trust, growth, and flexibility in their financial journeys.

As India becomes more financially aware, the demand for well-structured, transparent, and high-performance life insurance products is on the rise. Aviva meets this demand head-on, blending traditional insurance with modern-day investment tools for the benefit of all segments.

With global backing, a strong local legacy, and a sharp focus on value delivery, Aviva Life Insurance is a brand to watch in 2025 and beyond. These award-winning products serve as excellent benchmarks for others in the industry and great opportunities for customers looking for secure and rewarding insurance plans.

Aviva Life Insurance Wins Product of the Year 2025 FAQs

1. What is the Aviva Signature Increasing Income Plan?

The Aviva Signature Increasing Income Plan is a non-linked, non-participating savings plan offering guaranteed increasing annual income post-retirement. The income increases by a simple interest rate of 15% every 3 years during the payout phase. It includes life cover and optional accidental death rider, and you can choose income for up to 40 years.

2. How does the Aviva Signature Investment Plan (ULIP) work?

This ULIP plan is designed for long-term investment and life protection. It offers 8 fund options, zero premium allocation charges, and loyalty additions at maturity. It allows unlimited free switching between funds, making it a flexible investment option aligned with your financial goals.

3. Who should choose these Aviva Signature Plans?

These plans are ideal for working professionals, business owners, and families looking to secure long-term wealth or retirement income. Those who prefer transparency, zero hidden fees, and robust returns with insurance protection should consider these plans.

4. Are there any charges or deductions in these plans?

The ULIP plan includes standard fund management and policy administration charges, but there are no premium allocation charges. The savings plan includes fixed premium and optional rider costs, with no hidden deductions.

5. How can I buy the Aviva Signature Plans online?

Visit www.avivaindia.com, choose your desired plan, use the premium calculator, submit your KYC documents, and make payment securely online. The process is simple, fast, and paperless, and you’ll receive a digital policy copy upon verification.